This article discusses the pros and cons of operating as a sole trader versus limited company for 2023/24 taking into account the new corporation tax changes.

In tax terms, operating as a sole trader versus limited company for 2023/24, will still leave you with more spendable income where your profits are £50K per annum. However that's not the whole story and there are a number of other issues you'll need to consider.

Running your business as a sole trader

A number of businesses frequently start as individual freelancers. This can sometimes be referred to as being a self-employed sole trader.

Starting your business as a sole trader is a relatively straight forward process and there's less admin involved than a limited company. However we do recommend you carry out all business transactions via a separate designated bank account. We've discussed the benefits of operating in this way in a previous article.

Dealing with HM Revenue as a sole trader is also relatively straight-forward. As a starting point you'll need to register as self-employed with HM Revenue and file a Self-Assessment tax return. You'll also need to make the appropriate tax payments on account by the correct due dates.

Trading as a limited company

Many businesses choose to start as a limited company because of the perception that this provides enhanced status in the marketplace.

Some of the advantages of trading as a limited company vs sole trader are as follows:

There are also some drawbacks to trading as a limited company and a few examples of these are set out below:

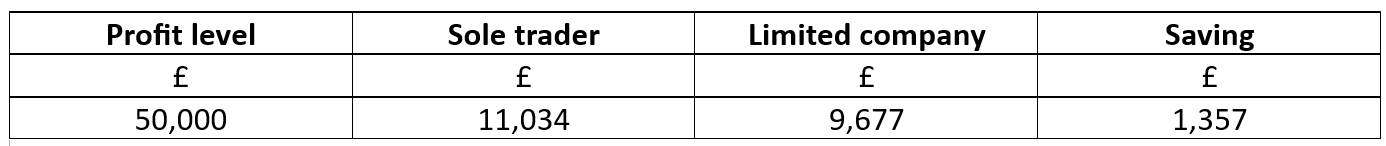

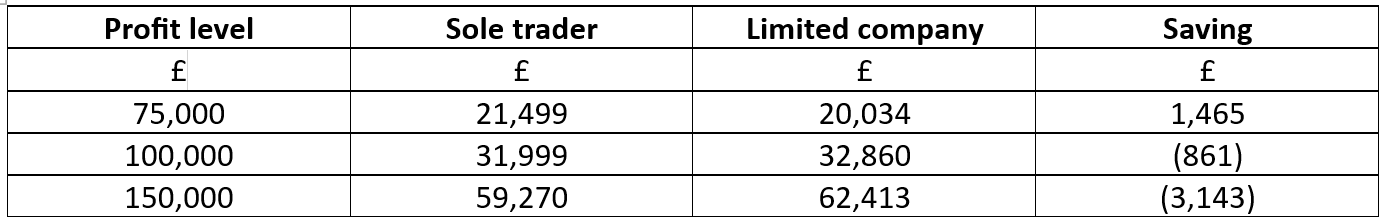

Last and by no means least, the tax liability is one of the most important considerations if you are considering limited company vs sole trader. We set out the tax position for the 2023/24 tax year below.

It's undeniable that the dividend tax introduced by George Osborne and the further changes implemented by Jeremy Hunt have eroded the potential tax savings available as a limited company previously. There also appears to be an underlying trend by the government to reduce the potential tax savings between a sole trader and a limited company structure.

We'd mention that the above calculations assume that all post corporation tax profits are paid out as dividends. However one of the advantages of a limited company structure is that unlike a sole trader an individual is only subject to income tax on those profits taken personally from their company. This can be particularly advantageous for example when it comes to avoiding the child benefit tax charge or the loss of the personal allowance when income/profits exceed £100K per annum.

Furthermore, if you do intend to retain profits in your business, it's undeniable that a limited company structure will save you tax.

For more useful information, check out our Ebooks here.

And if you'd like to know how we can help you with all of this, or with anything else, feel free to give us a call on 01202 048696 or email us at [email protected].

Alternatively, please feel free to complete our Business Questionnaire here.