Deciding whether to operate as a sole trader or limited company for 2025/26 depends on numerous factors. Your goals, income plans, and long-term strategy will influence your choice. This article will help you decide.

Advantages of Operating as a Limited Company

If you're deciding whether to start as a sole trader or limited company for 2025/26, starting as a limited company does offer numerous benefits:

- Easier to raise funds: A limited company attracts investors, especially this is especially useful for tech start-ups.. Options like EIS apply only to companies.

- Flexibility in profit sharing: You can split dividends among family members for additional tax savings.

- Tax savings on retained profits: Companies pay Corporation Tax currently at a maximum rate of 25%. Whereas sole traders pay income tax at a top rate of 45%. Because of the difference in tax rates a company has a greater ability to retain surplus profits for use at a later date.

- Lower tax on dividends: Dividends attract lower tax rates than salaries. What's more, they are also not subject to National Insurance contributions. This is particularly useful given the recent increases in the 2024 Autumn Budget.

- Tax-free perks: Directors of limited companies can claim tax-free benefits like training, mobile phones and low-emission cars.

- Family wealth planning: A company can transform into a Family Investment Company, enabling tax-efficient profit sharing with your family members.

Benefits of operating as a sole trader

For first-time business owners, starting as a sole trader is often simpler for the following reasons:

- Quick and easy setup: Setting up as a sole trader can be done easily.

- Straight-forward legal requirements: Sole traders follow general laws, unlike companies governed by the Companies Act.

- Simple transition: You can switch from a sole trader or partnership to a limited company as your business grows. However it's important to follow the correct steps. We'll discuss this in a separate article.

- Cash basis accounting: Only sole traders can use cash basis accounting. This can simplify your financial management particularly in the start-up phase.

Sole Trader or limited company for 2025/26 - tax savings

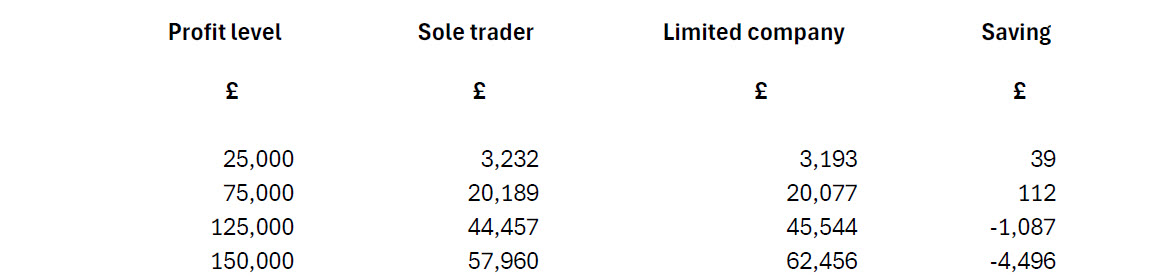

Any potential tax savings will also be a key consideration when deciding whether to operate as a limited company. The position for the 2025/26 tax year is covered below.

Choosing between operating as a limited company or a sole trader can significantly impact your tax liability. On the surface, you might think operating as a limited company means paying more tax. However, that’s not always true. The following assumptions can affect this conclusion:

- This is your only source of income, and full personal allowance and basic tax bands apply.

- You take a modest salary to minimise National Insurance contributions and claim the Employer Allowance. The increased rate of National Insurance Contributions from 6 April 2025 could have a negative impact.

- You extract all remaining profits as dividends.

There are a number of variables which influence these calculations and your potential tax savings.

- The ability to share the company’s income with your spouse or family members. This can reduce your tax liability significantly.

- Whether your business qualifies for specific tax reliefs, such as R&D tax reliefs. These can lower your overall tax bill.

- Your income from other sources. This could change the tax bands available to you.

- The level of employer pension contributions can also impact your tax planning strategy.

- How much profit you intend to retain and pay out as a capital distribution when you dissolve your company.

Summary

Tax planning for operating as a limited company is never a one-size-fits-all solution. You'll need to consider your income, family situation, business allowances, and future plans when making this important decision

For more useful information, check out our Ebooks here.

And if you'd like to know how we can help you with all of this, or with anything else, feel free to give us a call on 01202 048696 or email us at [email protected].

Alternatively, please feel free to complete our Business Questionnaire here.

[…] are lots of great reasons why people still choose to be sole traders, and it’s something that you are certainly going to want to be aware of if you are going to try […]